💡 Key Takeaways

- If someone dies without a will in New Jersey, state law decides who inherits your assets. Intestate succession may give your property to unintended heirs and delay probate under a court-appointed administrator, not your chosen executor.

- A spouse and children are typically first in line, but how much each receives depends on whether children are from the current marriage or a previous one.

- If there is no surviving spouse or children, the estate passes to the decedent’s parents, then to siblings, nieces, and nephews.

- Relying on default inheritance laws can lead to outcomes you wouldn’t have chosen, especially in blended families or unmarried partnerships.

- Creating a valid will ensures your property is distributed according to your wishes and can help reduce family disputes and probate delays.

Inheritance and succession laws dictate the distribution of an individual’s assets when they die without a will. This is also known as dying intestate.

Each state in the United States sets its own laws, so they can vary greatly. Our discussion today reviews some of the rules for distributing the assets of someone who dies intestate in New Jersey.

If you’re wondering, “what is a child entitled to when a parent dies without a will in NJ?”, or any other loved one, we have you covered.

(Note that there are key differences between a will and a trust. To learn more about trusts and how to set them up, read more in our article, Simple Trust vs Complex Trust in New Jersey)

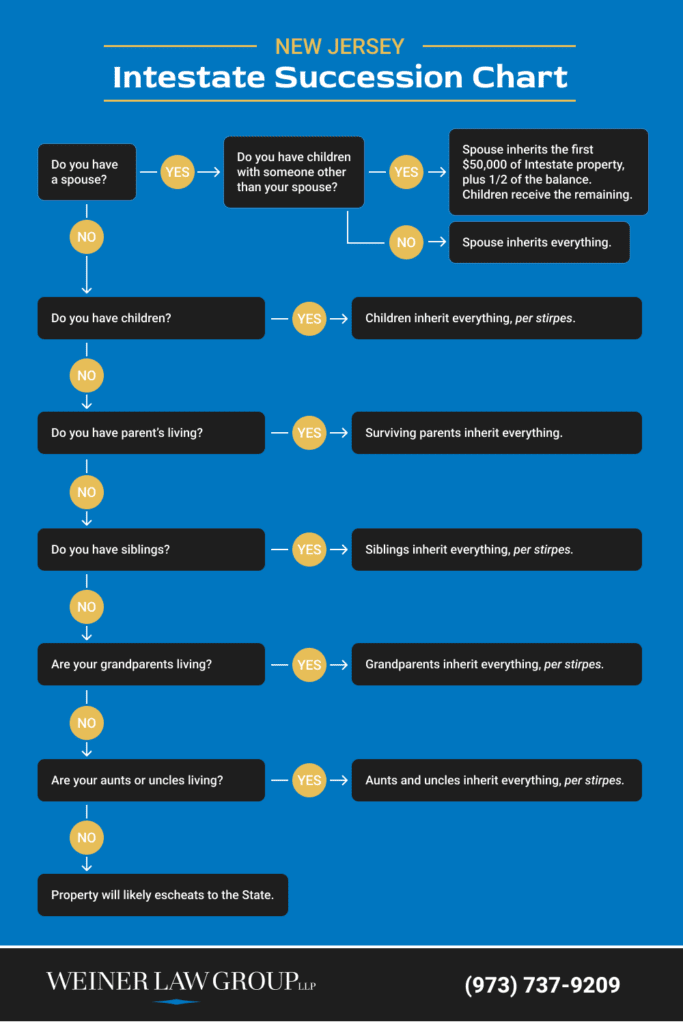

In New Jersey, the order of NJ intestate succession is determined by statute, which provides the rules for the order of inheritance among spouses, children, parents and other relatives.

To speak to an experienced New Jersey estate planning lawyer, please contact us today.

Order of Inheritance Under New Jersey Intestate Succession Laws

New Jersey intestacy laws determine asset distribution when a person dies without a will. The order of inheritance follows a set hierarchy based on the deceased’s family structure. Spouses, children, parents, and other relatives inherit according to legal priority. Specific rules apply depending on the surviving heirs.

When someone in New Jersey dies without a will, according to the law of NJ intestate succession, and if they:

- have a spouse, registered domestic partner, or civil union partner, and

- have children who are also the spouse’s or partner’s offspring,

then the spouse or partner inherits everything, and there’s no need to post a bond. A descendant is defined as the offspring of the decedent “across generations.”

Descendants are the blood relatives of the decedent. In other words, they are the biological children of someone in the decedent’s family tree.

For example, parents, grandparents, cousins or nephews. A spouse is created by marriage or an equivalent legal relationship, including a registered domestic partner.

NJ Intestate Succession for a Spouse

In New Jersey, if a husband dies without a will, the wife is entitled to inherit the first 25% of his intestate property, with a minimum amount of $50,000 and a maximum of $200,000.

Additionally, she receives half of the remaining balance of the estate. This is outlined in N.J. Stat. § 3B:5-3 (2024).

The surviving spouse of the decedent will receive the largest portion of the assets, while the remaining assets being divided among the children.

When there are no surviving children, other family members, including parents, brothers and sisters, grandchildren, nieces and nephews, and grandparents, may be entitled to a share of the estate.

The legal sequence in which relatives inherit the deceased person’s estate In New Jersey is determined by state statute.

If you pass away without a will in New Jersey, and you’re married, what your spouse inherits hinges on whether you have living parents or descendants—like children, grandchildren, or great-grandchildren. However, if you do not, your spouse receives all your intestate property.

If you pass away without a will in New Jersey, and you’re married, what your spouse inherits hinges on whether you have living parents or descendants—like children, grandchildren, or great-grandchildren. If not, your spouse receives all your intestate property.

Surviving Spouse

If the deceased individual (referred to as the decedent) leaves a spouse (we use spouse here to include a registered domestic partner, or civil union partner) and children who are also the children of the spouse or legal partner, then the spouse receives all of the assets in the estate.

Surviving Spouse and Children of Another Marriage

If the decedent leaves a surviving spouse, and children of a prior marriage, the spouse receives the first 25% (but not less than $50,000 nor more than $200,000), plus half of the balance of the estate.

The children of the decedent share the remaining balance of the estate. If a child has died before the parent and that child produced grandchildren, the grandchildren share the balance that would have been their parent’s share.

Surviving Spouse, No Children and Parents

When the decedent had a spouse, but leaves no children, and is survived by a parent(s), then the spouse receives the first 25% (but not less than $50,000, nor more than $200,000) plus three-quarters of the balance of the estate. The surviving parent(s) receive all other assets of the estate.

No Surviving Spouse, but Children

A surviving spouse typically inherits most or all of the estate, with the remainder divided among the children. If no spouse exists, children, whether adopted or biological, usually inherit the estate equally.

If a child has died leaving his or her own children, then those grandchildren will take their deceased parent’s share.

No Surviving Spouse or Children but Parents or Brothers and Sisters

When there is no spouse or children and surviving parents, the parents inherit the entire estate. If there are no surviving parents, but surviving brothers or sisters, those siblings share the estate equally.

Here again, if a sibling predeceased the decedent, then their children (nieces and nephews of the decedent) take equally in any share that they would have inherited.

Surviving Spouse and Children

If you die leaving a spouse, registered domestic partner, or civil union partner and children, and the surviving spouse or legal partner has children from a previous relationship, the spouse receives the first 25% (but no less than $50,000 and no more than $200,000).

Children of the decedent share the remaining balance of the estate.

Surviving Spouse and Only Stepchildren

Surviving stepchildren do not share in the estate of someone who dies without a will. If there is a surviving spouse and only stepchildren, the surviving spouse or legal partner receives 100% of the estate.

Other Descendants

The New Jersey statute defines a descendant, a relative within a parent-child relationship across generations.

When there are no children, spouse, parents or siblings, the estate goes to nieces, nephews and more distant relatives.

See what our clients have to say about our services:

No Surviving Spouse or Other Descendants, Stepchildren

When a parent dies without a will in New Jersey, their children are entitled to an “intestate share” of the parent’s property. The exact share each child receives depends on:

- The number of children.

- Marital status of the parent.

- Whether the surviving spouse is the other parent of the children.

- If the surviving spouse has children from another relationship.

Interests in the NJ Intestate Estate Pass by the Rules of ‘Representation’

When a decedent’s NJ intestate estate passes to descendants, as opposed to a spouse, it is divided “by representation.”

In that process, the estate is distributed in equal shares, divided among surviving descendants in the nearest generation and deceased descendants in the same generation.

Each surviving descendant is allocated one share, and any remaining shares are combined and divided among the remaining surviving descendants.

For example, if a decedent has three surviving children and one deceased child who left behind two children, the estate would be divided into four equal shares.

Each surviving child would receive one share, and the remaining share would be divided equally between the two grandchildren of the deceased child.

In those cases when the decedent’s NJ intestate estate passes “by representation” to the descendants of the deceased parents or grandparents.

The estate is divided into equal shares, with each surviving descendant allocated one share. The remaining shares are combined and divided among the surviving descendants, as if the surviving descendants had predeceased the decedent.

In this example, the estate of the decedent is divided into four equal shares: one for each surviving child and one for the two grandchildren of the deceased child.

This ensures that each surviving descendant receives an equal portion of the estate, while also providing for the deceased child’s children.

Do Grandchildren Inherit Parents Portion if Parent is Deceased?

When a parent passes away, their portion of the inheritance does not automatically transfer to grandchildren. Asset distribution depends on state intestacy laws and the presence of a will or estate plan.

Who is Considered Next of Kin in New Jersey?

The next of kin refers to the closest living relatives of a deceased person. This typically includes the spouse and children. If a child has predeceased the decedent but left grandchildren, those grandchildren are included. If there is no spouse or children, the decedent’s parents are listed.

What is the Order of Inheritance Without a Will?

If you lack a spouse or children, your parents inherit everything. Without a spouse, children, or parents, your siblings inherit everything. A spouse inherits everything if no children, parents, or siblings are present. If you have children but no spouse, the children inherit everything.

Distributing the Estate; The Role of the Administrator

An administrator is an individual appointed by the country Surrogate or the Chancery Court to manage the estate of the decedent and distribute the assets. Relatives may have a priority to serve as administrator.

The administrator has an obligation to locate individuals who are entitled to a share of the estate.

In Need of a NJ Intestate Succession or Estate Planning Lawyer in New Jersey?

If you have questions about inheritance and intestate succession laws in New Jersey, please contact our estate planning lawyers today.

Our experienced education law attorneys proudly serve clients in Parsippany, Bayonne, Vineland, Atlantic City, Jersey City, Old Bridge, Hoboken, Woodbridge Township, Bridgewater, Clifton, Elizabeth, Bergen County, Hudson County, Union County, Union City, North Bergen, Red Bank, and beyond.

FAQ: Intestate Succession in New Jersey

What is intestate succession in New Jersey?

Intestate succession in New Jersey refers to how a person’s estate is distributed when they pass away without a valid will. In these cases, New Jersey intestate succession laws determine who inherits and how assets are divided.

Who inherits property when someone dies without a will in NJ?

When dying without a will in New Jersey, inheritance typically passes to a surviving spouse, children, or other close relatives depending on the family structure.

Does a surviving spouse automatically inherit everything in New Jersey?

Not always. Spouse inheritance rights in NJ depend on whether there are children or other heirs. In some cases, the estate is shared.

How does intestate succession affect children in New Jersey?

Children inheritance rights in NJ are protected, and eligible children may inherit all or part of the estate when a parent dies without a will.

What happens if there is no spouse or children?

If no immediate family survives, New Jersey intestate succession looks to other heirs at law such as parents, siblings, or extended relatives.

Does intestate succession require probate in New Jersey?

Most intestate estates must go through the probate process in New Jersey so the court can oversee administration and distribution.

Who manages an intestate estate in New Jersey?

The court appoints an administrator—often a family member—to manage intestate estate administration in New Jersey.

How long does intestate probate take in New Jersey?

Timelines vary, but many intestate probate cases in New Jersey take several months or longer depending on complexity.

What if family members disagree about inheritance?

Disputes may arise over who inherits when there is no will in NJ. A probate attorney can help resolve disagreements and protect your rights.

Should I speak with a New Jersey probate attorney about intestate succession?

If you are navigating intestate succession in New Jersey, legal guidance can help ensure the estate is handled properly and efficiently.

Where to Find our Parsippany office: